Updated 4 months ago

Are Solar Panels Worth It in 2026 and Beyond? Rising Electricity Prices Say Yes

Written by

Andy Sendy

Find out what solar panels cost in your area

Yes, solar panels are still worth it for the vast majority of U.S. homeowners in 2026 and beyond, despite the end of the 30% federal solar tax credit for some systems. The primary financial driver is the cost of grid electricity, which is projected to rise much faster than historical averages. When combined with favorable net metering policies, solar systems provide significant long-term solar investment savings that outweigh the initial system cost.

The residential solar industry was rocked when the One Big Beautiful Bill ("OBBB") ended the Section 25D federal tax credit (a key tax incentive) on 31 December 2025 and shortened the life of the Section 48E solar tax incentive for third-party owned (leased or PPA) residential systems. The section 48E credit will now end on 31 December 2027, rather than the previous 2032 sunset date.

For homeowners looking to install solar panels, this bill means a significant financial shift. State-specific programs and utility rebates (another solar incentive) will now play a larger role in calculating upfront savings, as will rising utility electric rates. This shift underscores the growing importance of residential solar as a key component of the nation's renewable energy strategy and the broader move toward clean energy.

Respected solar data analytics and forecasting company Ohm Analytics projects that residential solar installations will fall by 25% in 2026 compared to 2025. This is far better than the 55% drop they forecast based on an earlier draft of the OBBB that would have eliminated both 25D and 48E by the end of 2025.

Forecasting the future is difficult, and we think the Ohm Analytics prediction is about right. What makes forecasting tricky is that there are both expansionary and contractionary forces acting on residential solar demand and on its supply cost. One key structural shift is that only leased solar systems will retain a tax credit under 48E after 2025. This will obviously be contractionary as many people prefer to buy solar systems outright and there will no longer be a federal 30% tax credit to do this. However, in this article, we explore why SolarReviews takes the view that any dips in demand for residential solar will be recovered in 2027 and that ultimately the industry will prosper.

Benefits of Solar Power: Why Going Solar Still Pays Off

At SolarReviews, we’ve been tracking residential solar extensively in both Australia and the U.S. Over decades, we’ve seen many solar incentive regimes rise and fall. What stands the test of time is this: demand for residential solar is more closely correlated with rising utility electricity costs than almost any other factor. In practice, homeowners care about monthly savings — the difference between what their utility bill would be and what a solar lease costs.

It's also essential to note that the long-term value case hinges on favorable net metering policies, which dictate how much credit homeowners receive for the excess energy (solar energy) they send back to the electric grid. While electricity costs drive the baseline energy costs, net metering rules are the crucial regulatory variable impacting final monthly savings.

Electricity Prices Are Rising Faster Than Historical Averages

We expect average residential electricity rates to continue climbing at ~5% per year, rather than the ~3% historical average. Why? Because the U.S. electric grid requires massive capital investment just to keep pace with electrification, resiliency, integration of renewable energy generation, and expansion.

One recent estimate from Deloitte finds that the U.S. power sector may require ~US $1.4 trillion of investment between 2025 and 2030 to modernize, expand, and integrate new loads.

The U.S. EIA reports that capital investment in distribution infrastructure alone increased by 160% from 2003 to 2023, as utility company facilities replaced aging lines, transformers, and added controls to manage new electric grid demands (DERs, storage, resilience).

Together, these data points show the scale and urgency of grid capex pressures — which ultimately get recovered through rate cases and are baked into consumers’ bills over time. This trend reinforces why homeowners view solar panels worth it as a crucial hedge against inflation.

When solar incentive policies disappeared in Australia, solar uptake remained resilient because electricity costs — not subsidies — drove the long-term value case. We believe the same will hold true in the U.S. as the 25D federal solar tax credit sunsets there may be a drop in demand for 6-12 months, but this demand will recover quickly, and we expect the same dip and recovery at the end of 2027 when the section 48E credit sunsets for leased solar systems.

Residential solar lease costs are trending lower

Contrary to what one might expect post-incentive change, we do not expect solar lease pricing to rise. Instead, we believe modest declines are ahead. Solar financing options must be accessible to minimize the barrier of the cost of solar panels.

In early 2025, SolarReviews surveyed hundreds of solar companies, finding the average cost for a first-year lease was about $22 per kilowatt (kW) per month.

Because of the domestic content and low-income adders to the Section 48E solar tax incentive (available until end-2027), we believe that figure will decline to around $18 per kW per month for many leases.

Additionally, we expect interest rates to come down through 2026–2027, lowering solar financing costs for lease providers and giving them more flexibility on margins.

As a result, the cost of a solar lease in 2026 might actually be slightly lower than in 2025, spurring demand for leased solar panel systems, even though the 25D incentives will no longer be available for purchased solar systems. A major distinction is that TPO agreements (like a PPA or lease) transfer ownership of the core components, like the inverter, to the providers, simplifying homeowner maintenance. In contrast, homeowners who get a solar loan own their systems outright.

Home Value Increases with Solar

When you go solar, you are making a home improvement that delivers guaranteed solar savings, a key selling point for future buyers. Studies consistently show that homes with owned solar system installations sell faster and at a premium compared to comparable non-solar homes, directly increasing your home value upon resale. Furthermore, the installation of a home solar panel system is often exempt from increasing property tax assessments, making the solar investment even smarter.

Utility Bills vs. Lease Costs: Calculating Your Payback Period

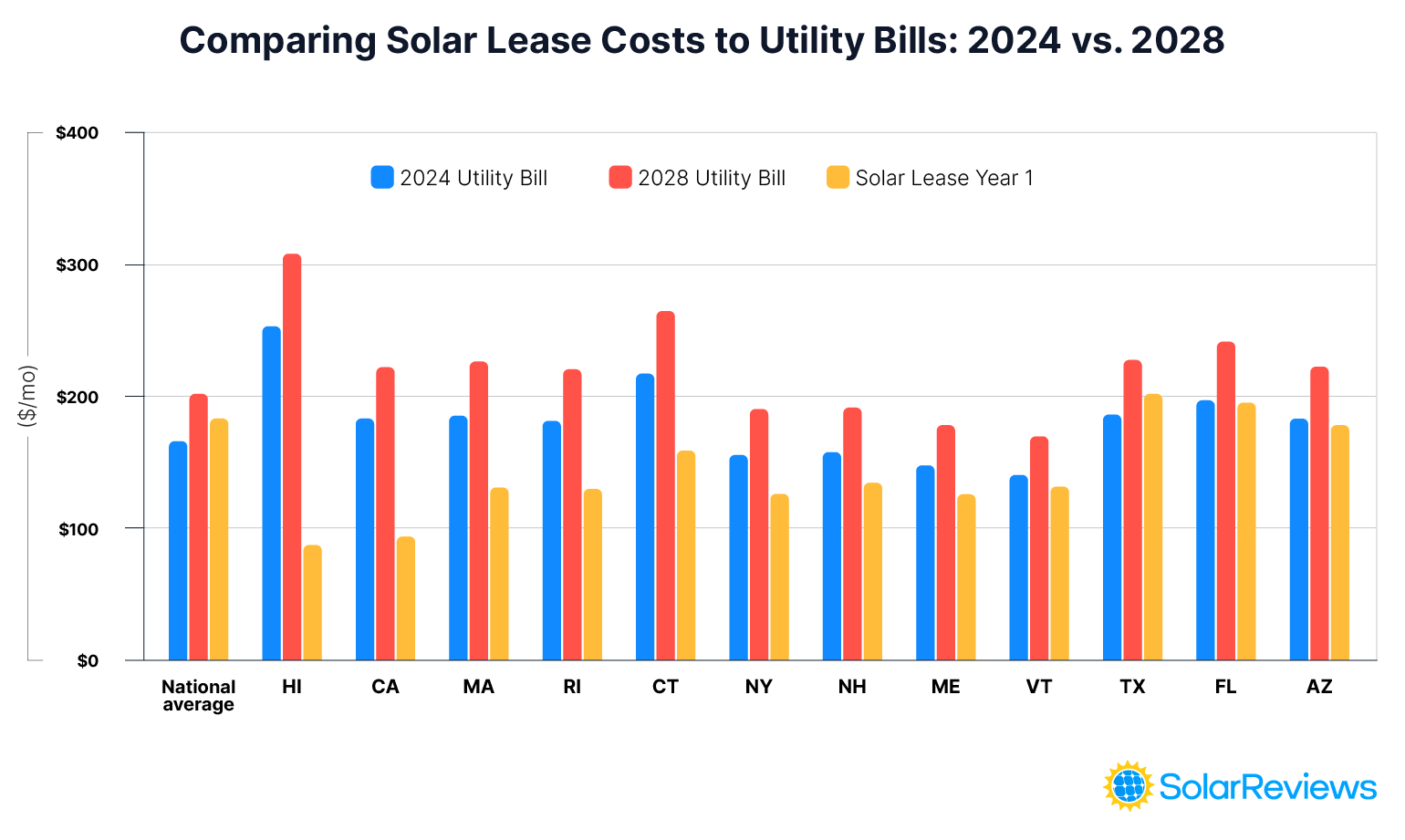

Below is a chart comparing 2024 utility bills, 2028 utility bills, and an estimated solar lease (Year 1) for single-family homes (assuming $18/kilowatt (kW) per month):

A comparison of average monthly utility bills for 2024 (blue) and projected bills for 2028 (red) against the estimated cost of a first-year solar lease (yellow).

In building this chart, we have increased the average monthly residential electricity consumption for each state by 15% to better reflect the higher usage of single-family homes. The required solar system size is calculated by dividing this adjusted usage by PV Watts production assumptions, then applying a 25% proportional adder to account for system inefficiencies and oversizing. Monthly utility bills are based on the adjusted usage and the average retail electricity price, with a 5% annual growth rate applied through 2028.

A state like Florida is a great example of where utility rate increases and interest rates reduction may cause a large increase in demand. In 2024 an average cost of first year lease payment was more than the utility bill it was offsetting, However, in 2028, on these assumptions, it will be on average $45 per month cheaper for a Florida homeowner to lease solar rather than continue to buy electric grid electricity.

Is Solar Worth It? The Net Result: Homeowners Save

When you stack rising utility bill payments (projected up 20%+ from 2024 to 2028) against relatively stable or declining solar lease costs, the value proposition for solar becomes compelling. This shows that whether solar is a worthwhile investment is a matter of simple math:

In high-cost states (Hawaii, California, New England), electricity costs could cross $200–$300/month by 2028.

A comparable solar lease in 2026 might cost $130–$200/month, depending on solar power system size and insolation.

Even in lower-rate states (Texas, Florida), high household usage often pushes monthly electric bill payments above $200/month, making home solar panel installations competitive.

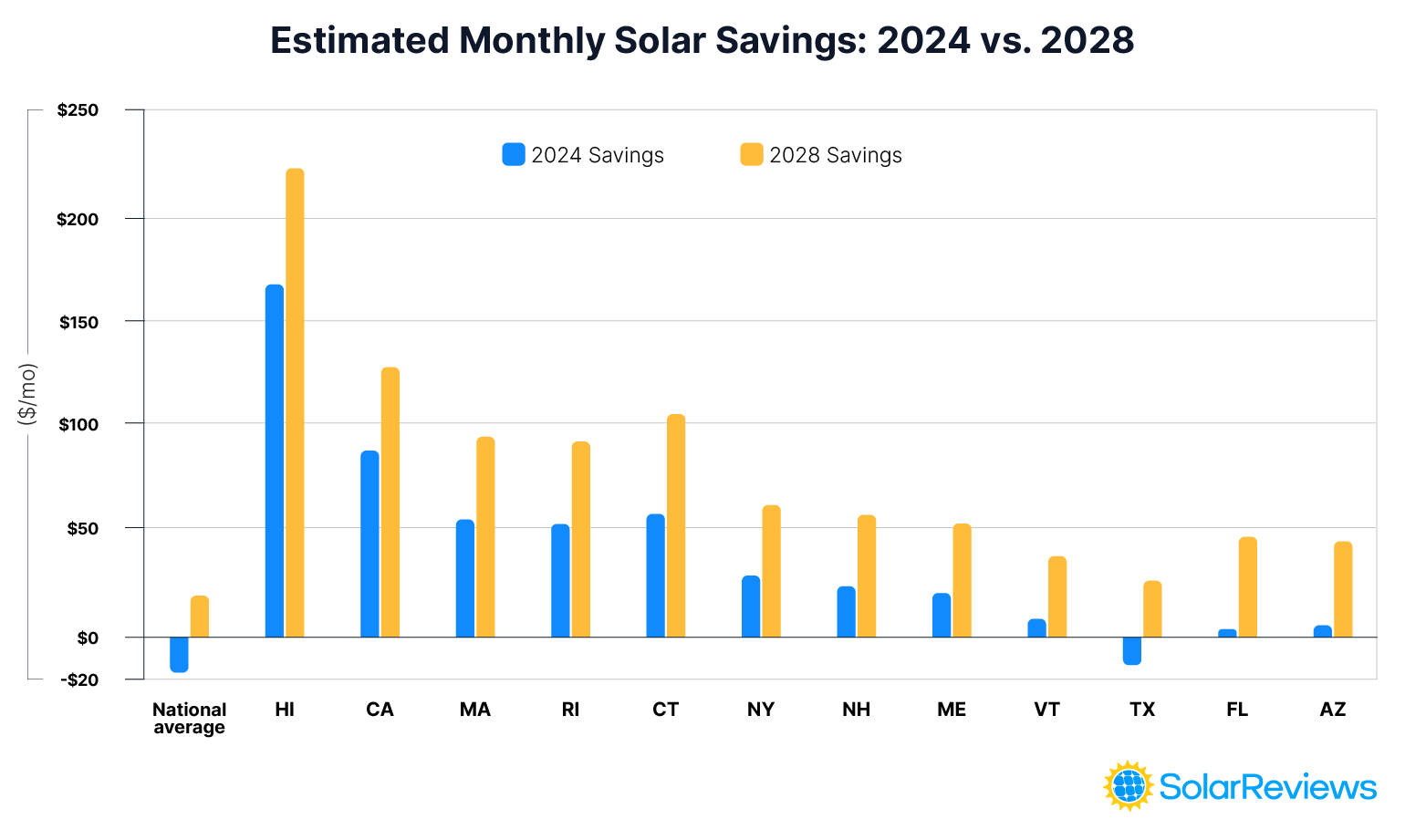

The chart below shows estimated monthly savings from switching to solar (positive and negative) in 2024 and 2028. It shows that even in states where it was not cashflow positive to move from electric grid power to a solar loan or PPA in 2024 it will be in 2028. In the states to the right of the bar graph, where it is already a net saving to do so, this monthly electric bill saving is significantly more and this should drive long-term demand.

Estimated monthly savings from a solar lease in 2024 (blue) compared to projected savings in 2028 (yellow).

We are nearing an inflection point when home solar panel systems become cashflow positive day 1 in many more states, and when savings become significant in states where there are already small net savings. Whilst a consumer may not be motivated to sign a solar lease to save $20 per month, the decision may be significantly different when these savings increase to $50–$100 per month.

Solar companies and providers must communicate these potential solar savings clearly to consumers, emphasizing that the long lifespan of a modern solar photovoltaic system ensures decades of clean energy generation. Advanced components like a solar battery and a smart inverter are transforming the equation further by enabling energy storage and protecting against power outages, potentially allowing users to go off-grid entirely.

At some point, as utility rates rise and the cost of solar panels falls, this will become true in many more markets.

Going Solar Is Still the Smart Investment

Even with the sunsetting of Section 25D and the shortening of 48E’s full applicability, we believe solar panel systems will still be worth it in 2026 and beyond for the vast majority of U.S. owners of single family homes. The rising energy costs and flattening or declining solar lease pricing make the math work — particularly when history suggests that electricity rates and favorable net metering policies, not subsidies, are the long-term demand levers for renewable energy and the shift to clean energy adoption.

This reinforces the core message: going solar is a smart solar investment with an accelerating return on investment (ROI), offering true energy independence from your utility company and reducing your carbon footprint by replacing power generated from fossil fuels with dependable, locally generated solar power system energy.

Andy Sendy is a well-known and trusted figure within the solar industry with more than 15 years of experience. His video reviews of the leading brands of solar panels and home energy storage batteries are a must-watch each year for both homeowners and solar industry professionals alike. In 2021, an article he wrote about a clause in the Tesla solar panel rental contract caused Tesla to change this clause within days. He was the founder of Sola...

Learn more about Andy Sendy