Updated 10 months ago

An Expert Guide to Solar Leasing: Pros, Cons, and Red Flags

Written by

Catherine Lane

Find out how much solar panels can save on your electricity bills each month

Solar panels are an excellent way to save money on electricity bills and reduce your reliance on your utility. However, a solar installation's price tag of $15,000 or more can be intimidating.

You may have heard of solar leasing as a way to get the benefits of solar panels without the hefty upfront costs. With a home solar lease, the solar company owns the solar panels on your roof, but you get to use the energy they generate to lower or eliminate your electricity bills.

So, what's the catch? While solar leases don't require an upfront payment and can be a great option for some homeowners, some bad actors use shady sales tactics to get people to sign contracts that aren’t right for them.

Our solar experts have put together this comprehensive guide to solar leasing to help you weigh the pros and cons of this financing option, identify red flags to look out for and decide if it's right for you.

Key takeaways

-

A solar lease is a solar financing option where a solar company installs and owns the solar panels on your roof, and you make monthly payments to the company to use the solar energy they generate.

-

Under a solar lease, the solar company owns the solar panels and gets to take advantage of rebates and tax incentives.

-

Solar leases provide predictable monthly payments, increase access to solar, and have no maintenance costs for the homeowner.

-

The biggest disadvantages of solar leases are that homeowners don't get the federal tax credit, long-term savings are lower than purchased solar panels, and it can be difficult to sell a home with leased panels.

What is a solar lease?

Leasing solar panels is like leasing a car: you don't own the solar panels, but you do get to use the solar energy they produce for a fixed monthly payment to the solar company.

Solar lease payments are typically designed to be lower than your pre-solar electricity bill, so you'll still see savings every month. Solar lease payments usually range from $75 to $200 per month, depending on the number of solar panels installed and local electricity costs.

Most solar lease agreements have terms of 25 years, with an option to either renew the contract, purchase the system, or remove the solar panels at the end of the term.

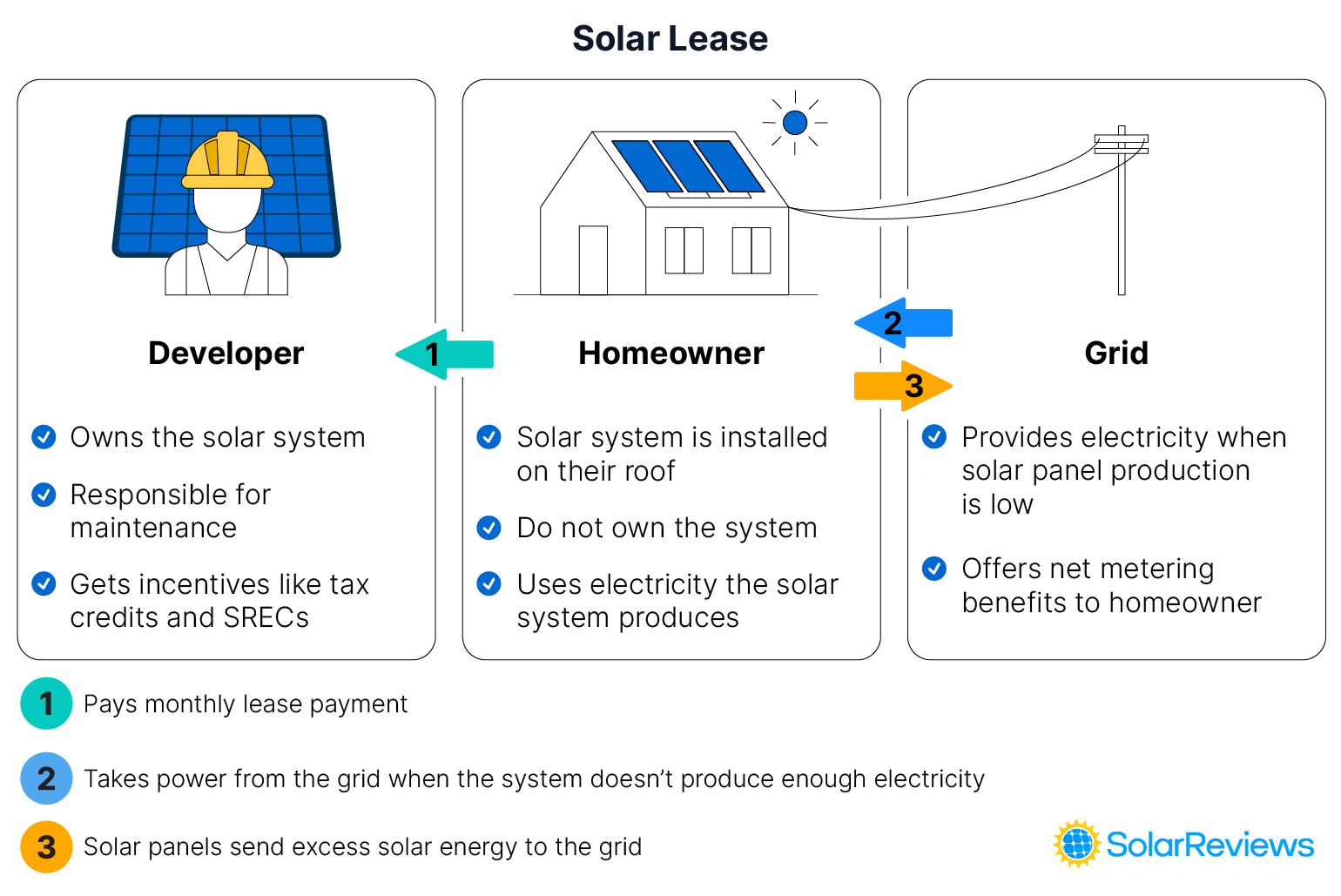

How does a solar lease work?

When installing solar panels through a solar lease, the solar company will put solar panels on your roof that will generate electricity for your home to use. You don't have to pay for the solar installation, but you will pay a flat monthly fee for using the solar energy produced.

Here are a few key things you need to know about how a solar lease works.

Monthly solar lease payments

Although you don’t pay for the solar installation, you’ll still need to pay a monthly solar lease payment. Most solar lease payments range from $75 to $200 per month, though this depends on the exact solar panel system design.

An important thing to note about solar leases is that the payments typically increase each year. The rate at which your solar lease payment will rise is specified in the escalator clause of your contract, with most escalator rates ranging from 1% to 5% annually. But, you should look for ones under 3% to avoid outpacing average electric rate increase in your area.

Savings

Solar lease payments are usually designed to be lower than your pre-solar electricity bill. With a solar lease, You can save between 10% and 30% on your monthly energy payments. For example, if your electric bill is $150 per month and your solar lease payment is $120, you save $30 per month with the solar lease.

The solar panels help reduce your electricity bills through net metering, a utility billing process that allows you to send energy back to the grid in exchange for bill credits. The solar energy first goes towards powering your appliances, and any excess energy is sent to the grid for credits that cover the cost of electricity you take from the grid later.

You might have two monthly payments! Even though a leased solar system will be designed to reduce your electricity costs, it might not cover all of them every month. As a result, you could have both an electric bill and a solar lease payment. This can happen for a few reasons, like unusually high electricity consumption, lower solar energy production, or you might have monthly utility fees that solar energy can't cover.

Incentives

When it comes to solar incentives, you likely can't take advantage of most of them beyond net metering. Under a solar lease, you, as the homeowner, don't own the solar panels—the solar company does. This means the solar company receives the direct benefits of incentives like the solar tax credit, local rebates, and performance-based incentives like Solar Renewable Energy Credits (SRECs).

Solar incentives are an important factor to consider when deciding whether to get a solar lease. If you don't have taxable income and can't claim the federal solar tax credit, a lease might be your best option. However, if you can take advantage of the tax credit, you should explore other financing options.

Maintenance + repairs

While you don't get to use incentives and rebates, there are some perks to the solar company owning the solar panels, with the biggest advantage being that you're not responsible for solar maintenance and repairs.

Although solar equipment has a very low failure rate, issues can arise, and when they do, it's the solar company's responsibility to fix them. This means you don't have to worry about organizing or paying for repairs.

However, this also means you're at the mercy of your solar company. If they don't prioritize repairing your solar power system, you could get stuck with a full electric bill and a full solar lease payment. Review your lease contract for any performance guarantees or clauses related to repair timelines to ensure you'll get timely service if something goes wrong.

End of lease

Solar leases typically have terms of 20 to 25 years, which is in line with the average lifespan of a solar panel. When the solar lease ends, there will usually be three options:

Renew the contract and continue using solar power and making monthly payments

Purchase the solar panels from the solar company

Have the solar panels removed from your roof

If you've been happy with your solar lease, consider renewing the contract. Just remember that solar panels are only warrantied to last 25 years, with a few brands offering 30-year warranties, so you'll have to consider the system's age in your calculations to see if it's worth it.

You can buy out the solar panels, take over the ownership, and continue using them without monthly lease payments. However, many solar lease buyouts are expensive, and you could have to pay the price of a brand new system for one that's 25 years old.

Pros and cons of solar leasing

Pros

-

$0 down payment

-

Immediate energy bill savings

-

Utilize clean energy

-

Not responsible for maintenance or repairs

-

Increases access to solar

Cons

-

Not eligible for tax credits or other incentives

-

Lower long-term savings

-

No added property value

-

Difficulty selling your home

-

Locked into a contract

-

Escalator clause

Advantages of solar leasing

$0 down payment: Solar leases don’t require any money upfront, making it easier for people to make the switch to solar without the burden of initial costs.

Immediate energy bill savings: With a solar lease, you start saving on your energy bills right away since you don’t pay anything upfront.

Utilize clean energy: Solar leasing allows you to power your home with clean, renewable solar energy.

Predictable payments: Lease payments are outlined in your contract, providing you with predictable monthly costs, unlike regular utility bills, which can fluctuate widely.

Not responsible for maintenance or repairs: Since you don’t own the solar panels, you’re not responsible for maintenance or repair costs that may come up.

Increased access to solar: The upfront cost of solar panels can be unattainable for many homeowners, and qualifying for solar loans can be challenging. Solar leasing makes solar energy more accessible to a wider range of people.

Disadvantages of solar leasing

Can’t use tax credits or other incentives: As the homeowner, you don’t get to take direct advantage of the solar tax credit or other incentives because you don’t own the solar panels. Instead, the solar company gets those benefits.

Lower long-term savings: Solar leases provide the lowest long-term solar savings of any solar financing option because the solar system can never “break-even” since you don’t own it.

No added property value: When purchased with cash or a loan, solar panels can increase your home value by an average of 6.9%. Leased solar panels don’t provide the same increase in property value since you don’t own them.

Difficulty selling your home: Selling a home with solar panels and a lease can be challenging, as many buyers may be hesitant to take over a contract initiated by someone else.

Locked into a contract: When leasing solar panels, you’re in a decades-long contract that is difficult and costly to break.

Hard to find point of contact: Some solar installers offer solar leases through a separate financing company, so establishing who to contact and who is responsible can be difficult.

Escalator clause: Escalator clauses in solar lease contracts outline how much monthly lease payments will increase by each year, meaning you’ll be paying more for solar, even though the system is aging.

Top solar leasing companies

Companies like Sunrun, Freedom Forever, and Trinity Solar are some of the biggest names in solar leasing. If you receive a quote from one of these companies or they try to sell you “free solar panels”, there’s a good chance that they’re trying to get you to sign a solar lease. The following table outlines some of the most popular solar leasing companies.

Company | Customer Review Scores |

|---|---|

Sunrun (2,798 reviews) | 2.6 / 5 stars |

Freedom Forever (400 reviews) | 1.8 / 5 stars |

Trinity Solar (231 reviews) | 3.17/ 5 Stars |

Momentum Solar (362 reviews) | 2.92 / 5 stars |

Sunnova (1,024 reviews) | 2.21 / 5 stars |

PosiGen (178 reviews) | 3.19 / 5 stars |

You might be alarmed by these customer review scores — and you should be. These companies have an overwhelming number of negative reviews, many of them for the same complaints: pushy salespeople, misleading sales tactics, and a lack of customer service when issues arise.

6 red flags to look out for when solar leasing

Solar salespeople will often highlight the best parts of solar leasing and will rely on you not knowing the ins and outs of these contracts so you sign them quicker. To avoid falling victim to a solar scam, keep an eye out for these solar leasing red flags:

Are there other ways to pay for solar besides leasing?

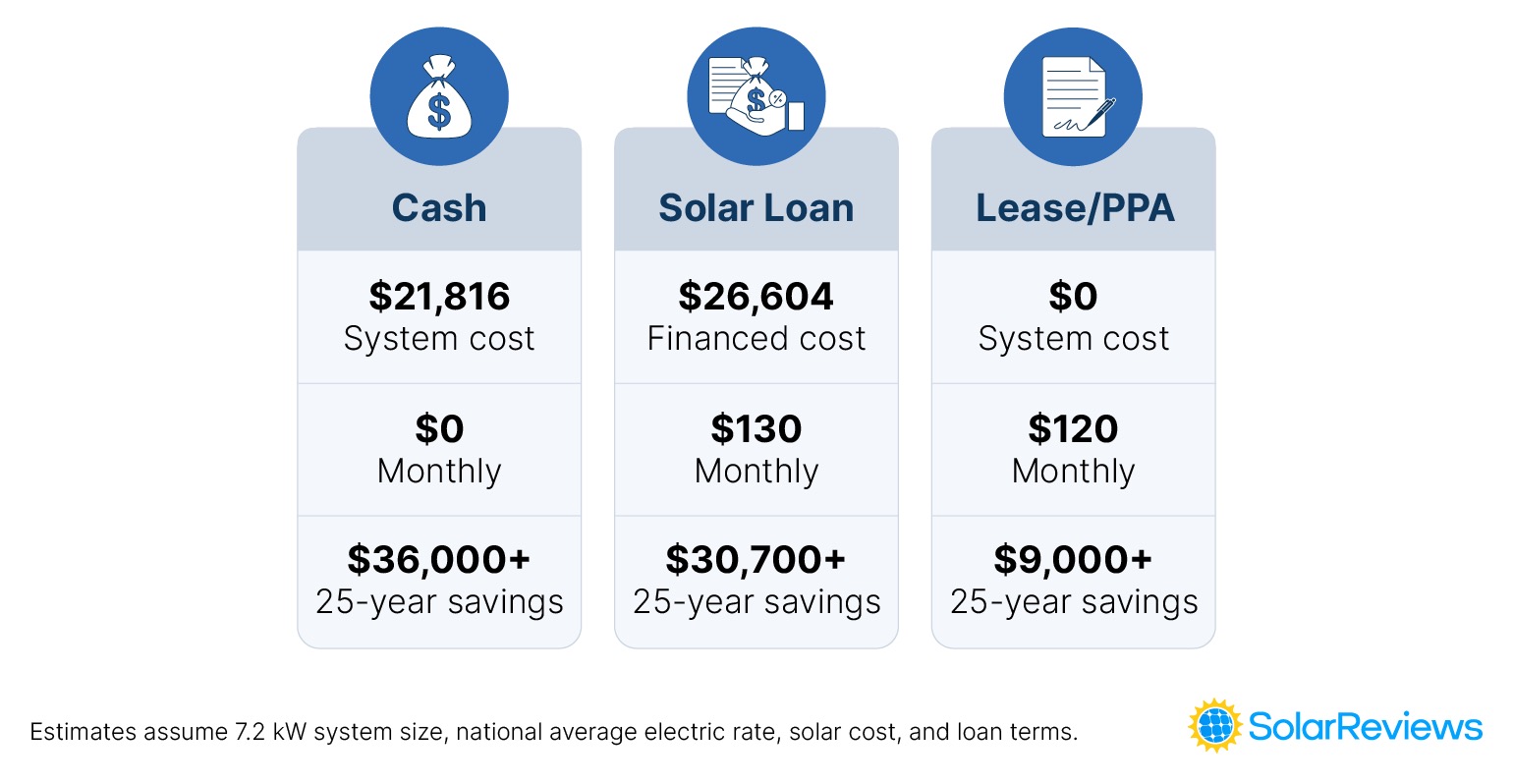

Yes, there are other solar financing options to help with solar installation costs. Aside from paying for solar energy systems with a solar lease, you can enter a power purchase agreement or take out a solar loan if paying cash isn’t an option.

Let’s see how solar leasing stacks up against other popular financing options:

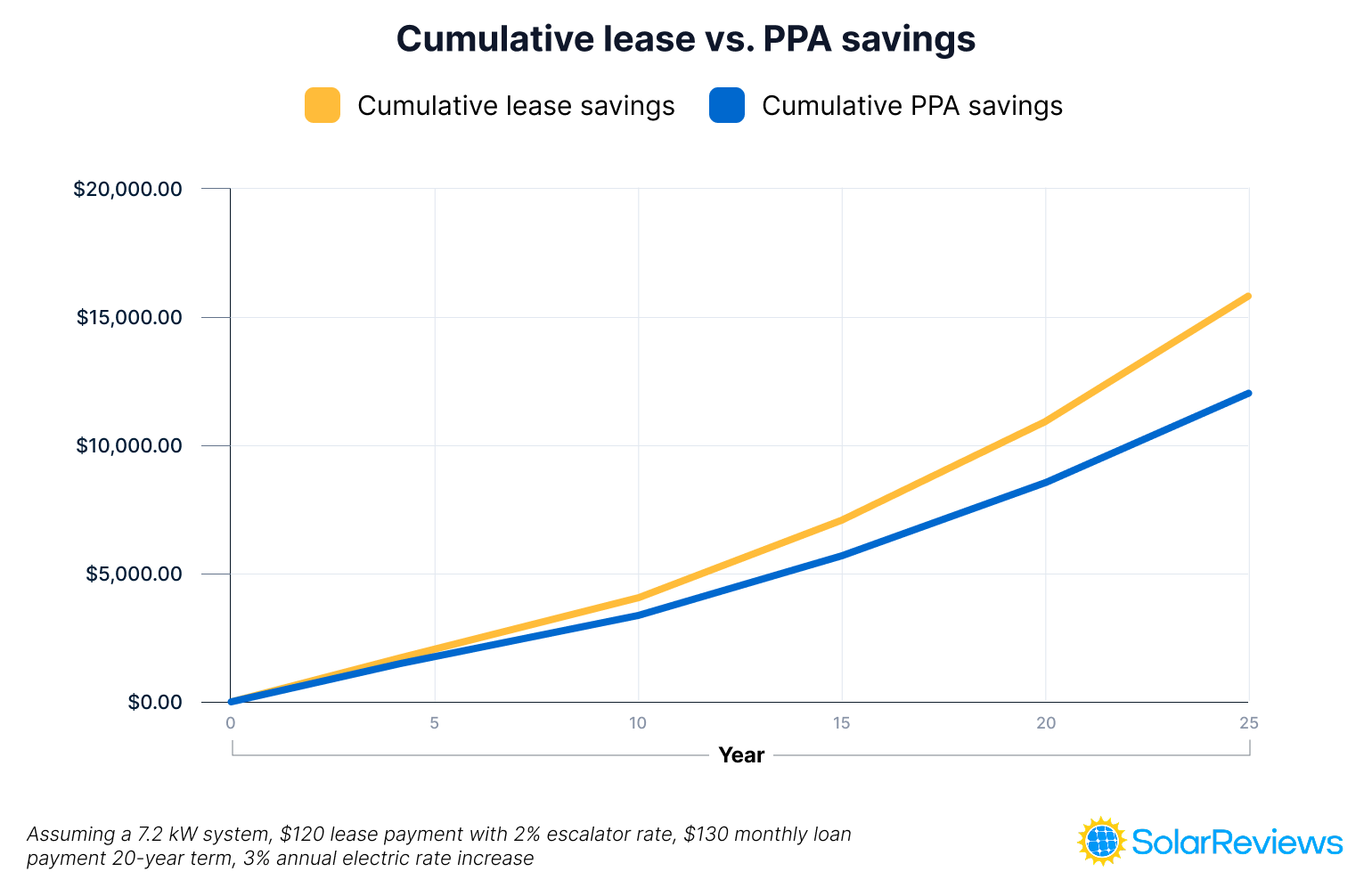

Solar leases vs. solar power purchase agreements

Solar leases are very similar to power purchase agreements (PPAs). With both options, a solar developer installs, owns, and maintains the solar panels on your roof.

The main difference lies in how you pay for the solar energy. Solar lease payments are fixed and remain the same each month, while solar PPA payments are based on the amount of energy the panels actually produce. PPAs include a rate per kWh of solar energy generated, which is usually lower than your local electric rate.

Lifetime solar savings for solar leases and PPAs are close, but PPAs could potentially save slightly more depending on system production. For example, if your solar panels produce less energy in April, a PPA payment will be lower, while a lease payment remains the same.

Both solar leases and PPAs come with the drawback that you won’t be eligible for tax credits or incentives like the federal solar tax credit or local rebates since you don’t own the system.

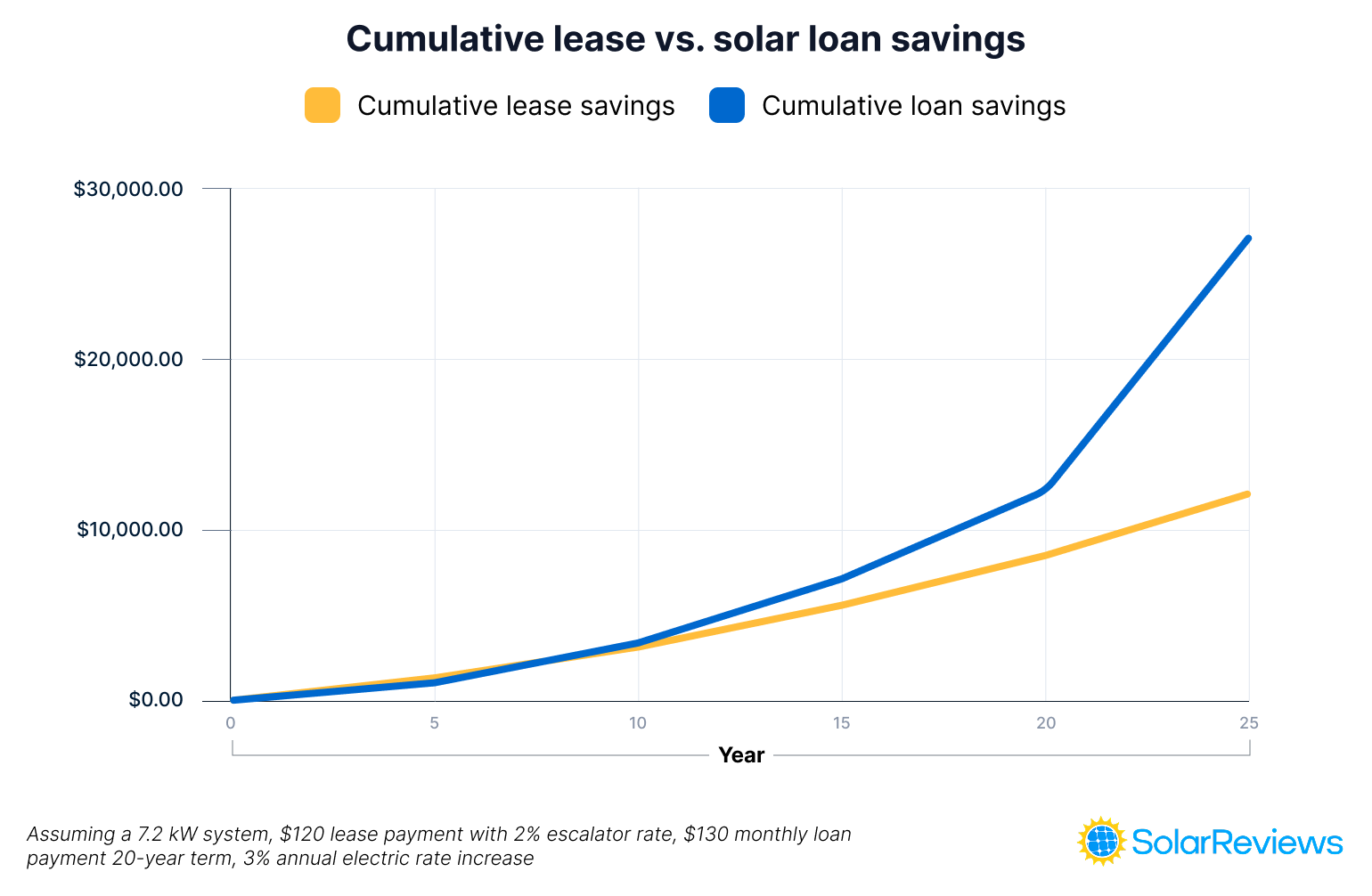

Solar leases vs. solar loans

Solar loans also help with the burden of the upfront solar investment but unlike solar leases, they allow you to retain ownership of the solar panels, providing better long-term savings.

Owning the solar panels means you get to take advantage of all available solar incentives, which can significantly lower the cost of going solar. Using a loan also increases the value of your home, making it an attractive feature for potential buyers if you choose to move.

Once the solar loan is paid off, your panels will provide you with free electricity. Solar leases, on the other hand, never reach that break-even point, so you'll never get completely free energy.

Is a solar lease a good idea?

Although "free solar panels" sound like a great deal, there are very few cases in which this is the best option for going solar. The only time that a solar lease makes sense is if you don’t qualify for the federal tax credit or don’t qualify for a solar loan.

The best way to finance solar if you don’t have the money for a cash purchase is with a solar loan. You get all of the benefits of installing solar, like electric bill savings and powering your home with renewable energy, plus you don’t have to worry about all the upfront costs.

Before you settle on a solar lease, you should get solar quotes from multiple local solar installers. They will help you get the best price on your solar system and give you a better idea about whether or not a solar lease will actually be right for your home.

Solar leasing FAQ

Catherine is a solar industry analyst and content manager with five years of experience researching and reporting on residential solar. As the former Written Content Manager at SolarReviews, she led a team producing informative content to help homeowners make informed decisions about solar investments. Her expertise has been featured in Solar Today Magazine and Solar Industry Magazine, with insights cited by major outlets including Forbes and Bl...

Learn more about Catherine Lane