Updated 6 months ago

The 30% Solar Tax Credit Is Ending in 2025: Are Solar Panels Still Worth It?

Written by

Andy Sendy

The 30% federal solar tax credit ends after December 31, 2025, and missing the deadline could add thousands to the cost of your home solar system. According to SolarReviews data, you can expect to pay $23,840 for a typical 8-kW solar installation. The tax credit cuts this amount by $7,152, bringing the out-of-pocket cost down to $16,688, but this incentive will no longer be available.

That said, going solar can still be a smart financial move. Home solar systems still offer a payback period below 10 years in states with expensive electricity and strong incentive programs. This includes New York, New Jersey, California, Massachusetts and Illinois.

Solar Federal Tax Credit: Before and After the OBBB

The 2022 Inflation Reduction Act originally extended the 30% Investment Tax Credit (ITC) through 2032, followed by a gradual phase-out: 26% in 2033, 22% in 2034 and 0% in 2035. However, the One Big Beautiful Bill (OBBB) was signed into law on July 4, 2025, shortening this incentive by nine years.

Solar panel systems owned directly by homeowners no longer qualify for the 30% ITC from January 2026.

This applies for systems purchased in cash or with loan financing.

The change also affects residential battery systems in both stand-alone and solar-plus-storage setups.

The outlook is more favorable for business-owned solar systems, including those used by homeowners under solar leases or Power Purchase Agreements (PPAs). These installations qualify for the 30% federal tax credit through 2027. Leased battery systems with at least 5 kWh of storage capacity are unaffected by the OBBB, remaining eligible for the 30% tax credit through 2032.

As a homeowner, you cannot claim the 30% ITC when leasing a solar system or signing a PPA. However, the system provider gets the incentive, and can transfer you some savings through reduced lease payments or a lower kilowatt-hour price.

30% Federal Tax Credit Deadlines after the OBBB, Based on System Ownership:

System Type | Tax Code Section | 30% Tax Credit Phase-Out |

Residential solar panels and batteries, direct ownership (cash payment or loan) | December 31, 2025 | |

Solar panels under third-party ownership (lease or PPA) | December 31, 2027 | |

Battery systems under third-party ownership (lease) | IRC §48E | December 31, 2032 |

Note: This article is for informational purposes only and is not intended as tax advice. For guidance on how to claim solar and battery tax credits, consult a qualified tax professional.

What Is the Solar Payback Period Without the 30% Tax Credit?

The payback period of home solar systems varies widely across the US. In states with expensive electricity and strong incentives, solar panels can pay for themselves in less than five years. On the other hand, a solar installation can have a payback period of over 15 years in states with low-cost electricity and no local incentives.

Without the 30% federal tax credit, solar payback periods will increase nationwide. However, the impact will be smaller in states with local tax credits and rebate programs. Here we analyze the payback period for an 8-kW solar system with a price of $23,840, before and after the tax credit phase-out.

Solar Payback Period, Based on US Average Electricity Costs:

Scenario | With 30% Tax Credit | Without 30% Tax Credit |

System Size | 8 kW | 8 kW |

Total Cost | $23,840 | $23,840 |

Net Cost | $16,688 | $23,840 |

Annual Savings | $1,922 | $1,922 |

Payback Period | 8.7 years | 12.4 years |

Note: These estimates assume the system generates 11,000 kWh per year in a site with favorable sunshine, based on US solar productivity data from the Global Solar Atlas. Annual savings are based on the national average electricity rate of 17.47 cents per kWh, from the latest Electric Power Monthly report by the US Energy Information Administration.

The payback period extends by nearly four years in this example, but remains well below the 25-year lifespan of solar panels. Also, the estimate is based on US average data, without considering state-specific incentives and electricity prices.

If we analyze the solar payback period in a place like New York, the outlook is much more favorable. The state offers a tax credit covering 25% of system costs, up to $5,000, which remains available after 2025. New York also has an average electricity rate of 26.67 cents per kWh, well above the US average, which translates into higher savings when using solar panels.

Solar Payback Period, Based on New York Electricity Costs and Incentives:

Scenario | With 30% Tax Credit | Without 30% Tax Credit |

System Size | 8 kW | 8 kW |

Total Cost | $25,760 ($3.22 per watt) | $25,760 |

Net Cost | $13,032 | $20,760 |

Annual Savings | $2,934 | $2,934 |

Payback Period | 4.4 years | 7.1 years |

In this case, the payback period remains well below 10 years even with no federal tax credit. New York also has a favorable net metering policy for solar installations up to 750 kW, meaning you save the full value of each kilowatt-hour generated by your panels.

Top States for Solar Energy After the 30% Tax Credit Ends

The following states offer some of the best solar incentive programs in the US, while having above-average electricity costs. Homeowners who go solar in these states can still expect a strong return on investment:

State | Average kWh Price (US EIA) | Main Solar Incentive Programs |

Connecticut | 31.64 ¢/kWh | Residential Renewable Energy Solutions (RRES): High solar buyback rates for systems up to 25 kW. |

Massachusetts | 29.94 ¢/kWh | State income tax credit: 15% of solar system costs, up to a maximum of $1,000. Solar Massachusetts Renewable Target (SMART): Performance-based incentives for solar systems during the first 10 years of operation. |

Rhode Island | 29.00 ¢/kWh | Renewable Energy Growth (REG) Program: High solar buyback rates for systems up to 25 kW. Renewable Energy Fund (REF) Small Scale Solar Grants: $0.65 per watt, up to $5,000 per system. *The REG and REF programs are mutually exclusive, you can only choose one for your solar installation. |

New Jersey | 20.49 ¢/kWh | Successor Solar Incentive (SuSI) Program: Earn one Solar Renewable Energy Certificate (SREC) for every 1,000 kWh generated. Each credit sells for $85 as of 2025. |

New York | 26.67 ¢/kWh | State income tax credit: 25% of solar system costs, up to a maximum of $5,000. NYSERDA Megawatt Block Program: Rebate of $0.15 per watt of solar capacity. Available only in Upstate New York, depleted in New York City and Long Island as of 2025. |

Illinois | 18.62 ¢/kWh | Illinois Shines: Upfront incentive based on projected solar generation during 15 years, can exceed $9,000 for larger residential systems. Smart inverter rebate: $300 per kilowatt-DC for Ameren and ComEd customers. |

California | 35.03 ¢/kWh | Self-Generation Incentive Program (SGIP): Stand-alone and solar paired batteries get a rebate of $0.15 per watt-hour of storage capacity ($150 per kWh). |

Hawaii | 41.03 ¢/kWh | State income tax credit: 35% of solar system costs, up to a maximum of $5,000. |

Washington DC | 20.15 ¢/kWh | DC SREC Program: Earn one SREC for every 1,000 kWh generated. Each credit sells for around $400 as of 2025. |

Why these states stand out: High electricity rates increase the annual savings from home solar systems, while incentive programs reduce upfront costs or provide additional income.

Rising Electricity Rates: Another Reason to Go Solar in the US

Although the 30% tax credit is ending, another factor is making solar power more attractive for homeowners: rising electricity prices. According to a Carnegie Mellon study from June 2025, this trend will continue due to growing consumption from AI and cryptocurrency data centers. Technologies like electric vehicles (EVs) and heat pumps are also driving up demand on US power grids, combined with the ongoing effect of population growth.

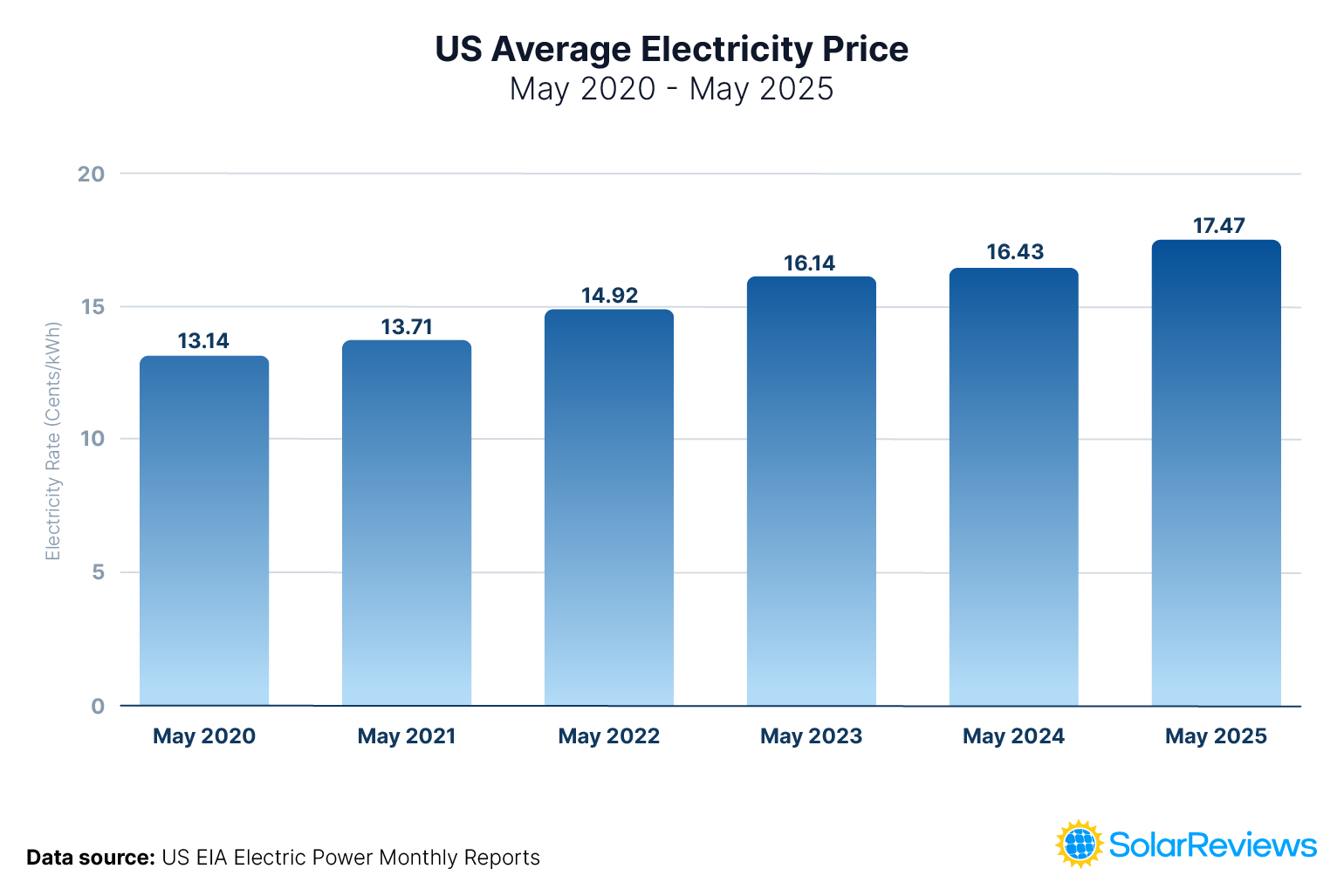

The chart below shows the increase in US average electricity costs from 2020 to 2025:

Source: US EIA Electric Power Monthly Reports

In 2020, every 1,000 kWh of solar electricity generated at home saved around $131. As of 2025, this figure has increased to $175. In other words, the power generated by residential solar systems became 33% more valuable within a five-year period.

Who Can Claim the Solar Federal Tax Credit?

The Section 25D Investment Tax Credit is available for renewable energy systems installed in primary residences. This means you cannot claim the tax credit for a vacation home or a rental property. Additionally, you must own the system directly to qualify for the 30% ITC. There is no tax credit limit as long as you meet all these conditions. Finally, if the solar tax credit exceeds your annual tax payments, you can roll over the unused difference to future tax filings.

On the other hand, the Section 48E Investment Tax Credit is for business-owned renewable energy systems. While this is not a direct incentive for homeowners, it reduces system costs for solar lease and PPA providers, contributing to lower service prices.

Do Solar Loans and Leases Change Without the 30% Tax Credit?

If you purchase a home solar system with loan financing, it counts as directly-owned from day one, even if you’re making monthly payments. This means you can claim the 30% federal tax credit for yourself, but only if you complete the installation by December 2025. Many solar loans are composed of two elements:

A primary loan that covers the net system cost (70%).

A bridge loan that covers the 30% difference, which you repay as soon as you claim the federal tax credit.

Solar loans will no longer have the bridge component when the ITC ends. This means you can expect more interest and higher monthly payments throughout the financing term. To compensate for this, you can look for loan options that allow prepayment with no penalties.

On the other hand, leased solar systems count as third-party owned (TPO), which means they remain eligible for the 30% ITC through December 2027. When the residential tax credit phases out, there is no direct impact on the cost of solar leases and PPAs; the companies offering them rely on the business tax credit.

Solar Federal ITC Phase-Out: Final Recommendations

The Clean Energy Investment Tax Credit might be ending, but home solar systems will remain a smart investment in many states. However, missing this incentive could mean paying around $7,000 more for an 8-kW solar system.

Although the tax credit remains available through the end of 2025, the best recommendation is acting now. Installing a home solar system can take over 60 days considering the entire process: design, permitting, installation, inspection and utility approval. The installation itself only takes around 1 to 3 days, depending on system size and roof complexity, but you must plan for the previous paperwork.

The demand for solar installation services could spike during the last months of 2025, as more homeowners rush to beat the December deadline. By starting the process soon, you have much better chances of securing the 30% federal tax credit.

Andy Sendy is a well-known and trusted figure within the solar industry with more than 15 years of experience. His video reviews of the leading brands of solar panels and home energy storage batteries are a must-watch each year for both homeowners and solar industry professionals alike. In 2021, an article he wrote about a clause in the Tesla solar panel rental contract caused Tesla to change this clause within days. He was the founder of Sola...

Learn more about Andy Sendy