Updated 1 year ago

What ADT’s acquisition of Sunpro means for homeowners - and the solar industry

Written by

Ben Zientara

Note: In January 2024, ADT announced it would close all its ADT Solar branches and exit the solar business. The article below discussing ADT's initial acquisition of Sunpro Solar remains as it was when it was written in November 2021.

On November 9th, 2021, ADT announced its intention to acquire Sunpro Solar for approximately $825 million in cash and ADT stock. The acquisition will result in a new nationwide solar brand called ADT Solar, which will retain Sunpro’s founder and management team as it rapidly scales to address a much larger market.

Founded in 2008, Sunpro has become one of the largest residential solar companies in the United States, serving customers across 21 states that span the south and midwest. The company’s website now claims more than 30,000 completed solar installations, which equals around 1% of all residential solar installations ever completed.

ADT is a publicly-traded nationwide home security company with more than 6 million customers. The company has stayed relevant by partnering with Google and other companies, bringing a smart home and security platform to a marketplace where customers are hungry for home automation and smart tech integrations.

To those in the residential solar industry, this is huge news, and its effects will be felt for years to come. We reached out to ADT’s PR team for a word on the plans for the acquisition, but they were unable to say anything more than was published in their press release, which makes sense, as the acquisition continues through regulatory approvals and the closing process.

What we can do now is discuss where Sunpro has been and what might be coming in the future. The text below contains some links to the Sunpro website as it existed on this article’s publication date of November 18, 2021. We anticipate that the content on these pages will change in the future, and will do our best to keep up with the changes.

Sunpro’s current business

As mentioned above, Sunpro currently operates in 21 states, and has completed over 30,000 solar installations. Not only that, it was recently named the #2 residential solar company in the country by Solar Power World magazine. In fact, ADT pointed out in its press release that Sunpro’s installation volume increased by 90 percent in 2020 over 2019.

On SolarReviews, Sunpro maintained an average review score of 4.25 out of 5 stars or above from 2018 to 2020.

The company stands out in the home solar space for several reasons. First, its founder also owns Buildpro and Energypro, separately registered entities that offer roofing and home energy auditing services alongside the solar company’s offerings.

In Sunpro quotes we’ve seen, the company offers the homeowner a chance to get a free Energypro home energy audit and pays for efficiency and weather-proofing services like attic and duct insulation, water heater blankets, LED lights, smart thermostats and more. This integrated approach helps homeowners reduce their energy consumption and leads to a smaller solar system, with similar energy savings as companies offering larger solar-only installations.

At the time of this article, the Energypro service was available in 9 of the 21 states served by Sunpro. Buildpro Roofing was available in 20 states. There is no indication in the ADT acquisition announcement that it intends to acquire Energypro and Buildpro as well.

In addition to the energy-efficiency focus in its sales process, Sunpro stands out from the competition in that it offers a 25-year guarantee for labor and power production to go along with manufacturers’ warranties of the equipment it uses. The company provides its customers with a promise that if their system underproduces over the course of its 25-year lifetime, they’ll pay the difference in savings in cash.

There’s no guarantee that any of these business practices will be incorporated into the future ADT Solar, so all we can do now is speculate about what might happen.

Speculation about the future

In its press release, ADT says it expects that ADT Solar “will immediately become a leading national residential solar installer,” aided by its nationwide network of 3,000 salespeople who together visit 10,000 households per day all across the country.

That implies they won’t be confining themselves to Sunpro’s current southern United States service territory.

With ADT’s brand recognition and solid solar installation operations, the possibilities are vast. The companies’ employees and managers are no doubt filling the meeting rooms and Zoom chats with ideas big and small.

Let’s dive into a couple of thoughts on what ADT Solar might mean for the solar industry and potential customers.

What this could mean for the industry

According to data from the U.S. Energy Information Administration (EIA), the residential solar industry has been growing by about 30% per year over the last few years. The major players in the industry include national installation companies like Sunrun, Sunpower, and Tesla, alongside super-regional companies like Titan, Momentum, and Trinity.

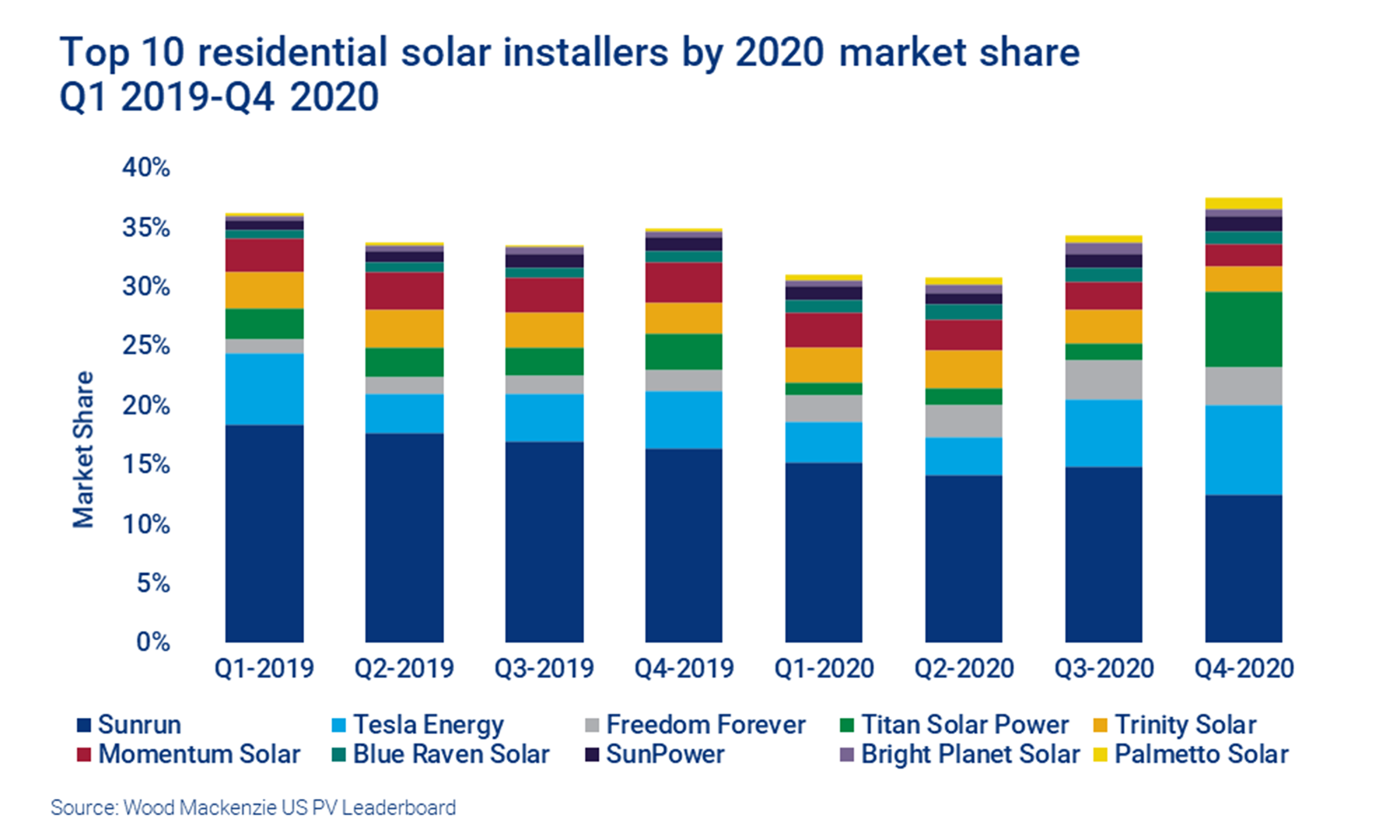

The top 10 U.S. residential solar companies jockey for position on the leaderboard, splitting a share of around 35% of the total market. The other 65% of U.S. residential solar customers are served by smaller local companies spread all across the country.

This chart from Wood Mackenzie shows how those top 10 companies fared during 2019 and 2020:

Image source: Wood Mackenzie

The increasing volumes at which solar installations are being completed is a bit obscured in the above graph. For example, Sunrun didn’t install meaningfully less solar in Q4 of 2020, despite its shrinking portion of that column. Instead, it continued to install at a similar volume, and the overall market grew in size.

ADT has a stated goal of tapping into its 6 million customers, in addition to finding new ones, to sell its new solar solutions. If many of those 6 million customers are among the 97% of households currently without solar panels, it could be a huge win for the company.

ADT Solar could conceivably match Sunrun’s current share of installations in 2022, and given the 30% annual growth in the market, could do so without actually causing Sunrun to install less solar next year. This might be a case where a rising tide does indeed lift all boats.

ADT Solar’s national solar brand competition

On a national level, two main brands stick out: Sunrun and Tesla.

Sunrun started in 2007, offering Power Purchase Agreements (PPAs) and solar leases in California, and quickly grew into a national company following rounds of funding from venture capital and traditional investors.

The company went public in 2014, and has enjoyed tremendous growth ever since, despite losing money in three of the last four quarters (Q4 2020 to Q3 2021). The company’s promise is in its expected future income and annual growth; in 2020, Sunrun acquired longtime rival Vivint Solar and is now the largest residential solar company in the country.

Tesla Solar was formed whole-cloth out of the remains of what had once been the nation’s largest installer, SolarCity. Tesla acquired the troubled SolarCity in 2016, but found some difficulty operating the business successfully during the transition and lost significant market share.

More recently, Tesla has been struggling to launch its solar roof product profitably, while experimenting with solar subscription models and low-cost solar panel systems with Powerwall batteries included. Tesla’s Energy division also barely turns a gross profit, and currently operates at a net loss for the company.

What ADT needs to succeed nationally

If ADT Solar is going to compete with these two national companies (not to mention the other eight big-and-growing brands in the chart above), it will need to provide a comparable product or service at similar prices.

It might seem like an easy battle to defeat two foes who regularly lose money, but a head start is still a head start, and Tesla and Sunrun are both well-known solar brands. ADT of course has its own recognizable and trusted brand name, and we’re looking forward to seeing if they can leverage it to convince customers who might not otherwise consider solar for their homes.

That means the company will need to define the equipment it will use, the types of financing it will offer (PPA, lease, loan), and whether it intends to create its own branded ecosystem of energy management hardware and software, like solar batteries, inverters, and monitoring applications.

Finally, ADT solar will need a lot of workers from all around the country in order to compete. We wonder whether ADT Solar would employ its own installation crews, or instead operate on a dealer model, in which existing local solar installation companies would be certified to sell and install ADT’s integrated solutions. The latter would seem the obvious choice, and would allow ADT to scale quickly to service customers all across the country.

If our assumption about a dealer network model is true, it would probably mean two things, which would affect homeowners and the solar industry alike:

ADT entering the market will increase the number of solar installations completed in the U.S. next year, probably by more than what it would have been without ADT

The percentage of installations completed by smaller local companies will decrease, as local companies sign on to become dealers for ADT

Expanding the solar industry is a good thing, and the pace of installations next year will likely pick up anyway, as the federal solar tax credit is set to step down after 2022.

One potential stumbling block for the whole industry is the patchwork of regulations, utility rules, and renewable energy laws that differ widely from state to state and utility to utility across the country. Something ADT can do to help is to join nationwide and state solar associations and trade groups, and push for an extension of the solar tax credit and better nationwide policy to support homeowners going solar. Proposals to do just that exist in the current version of the Build Back Better Act.

We’re hoping ADT Solar will be a win for the industry and a win for customers, too.

Editor’s note: After this article’s publication date, congress passed the Inflation Reduction Act, extending the solar tax credit at 30% of costs through December 31st, 2034, and expanding it to include standalone battery storage systems, among other things.

What this could mean for customers

Homeowners who are currently ADT customers could soon be offered solar products that integrate with either current or upgraded smart home systems to provide energy management and bill savings. Future ADT customers will likely be offered package deals on security, smart home, and solar services.

We wonder whether the existing Energypro services fit into ADT’s business model. They are currently a unique value that Sunpro provides compared to other large solar installers, and could easily be included in an all-around package deal that includes security and solar.

We also wonder about the business model. ADT has long operated on a subscription model, but also offers DIY home security (and a la carte professional monitoring) under its “Blue by ADT” brand. Would it seek to sell solar exclusively through a subscription, or would it offer loans and cash purchases as well?

The subscription model can work for solar—as we mentioned above, Sunrun is famous for its PPAs. Many other large installers now offer homeowners 25-year solar loans that come with maintenance and service agreements, which almost become de facto “solar as a service” contracts, but end with the customer owning the system (unlike PPAs).

But many people would prefer to pay cash or take out a home equity loan in order to realize the most economic benefit from their solar investment. Needless to say, the solar market has thrived in the last decade by offering its customers a wide variety of choices in hardware, software, and financing.

Solar is not a one-size-fits-all proposition, as Tesla has discovered time and time again. We hope ADT Solar adds value by combining its existing solutions with new products and proven solar business practices, and also that it proves itself nimble enough to meet its customers where they are. That means they have to be willing to sell solar for a cash price, alongside any planned long-term agreement model.

Ben Zientara is a writer, researcher, and solar policy analyst who has written about the residential solar industry, the electric grid, and state utility policy since 2013. His early work included leading the team that produced the annual State Solar Power Rankings Report for the Solar Power Rocks website from 2015 to 2020. The rankings were utilized and referenced by a diverse mix of policymakers, advocacy groups, and media including The Center...

Learn more about Ben Zientara