Updated 10 months ago

Does Homeowners Insurance Cover Solar Panels?

Written by

Dan Simms

Find out what solar panels cost in your area

Investing in a solar array is one of the best ways to save on monthly utility bills and reduce your carbon footprint, but the equipment is expensive and constantly exposed to the elements.

Many homeowners wonder about solar panel insurance coverage and whether a standalone policy is necessary or if homeowners insurance covers solar panels. In this guide, we’ll explain what solar coverage your existing home insurance policy includes and whether or not you need standalone protection.

Note: We’re solar experts — not insurance experts! Contact your insurance agent to get the most accurate information regarding your homeowners insurance policy and how solar panels will impact it.

Solar panel insurance at a glance:

-

Most homeowners insurance policies cover solar panel systems.

-

Solar panels can increase your insurance premium costs if the system makes the replacement value of your home exceed your coverage limit.

-

Increasing your coverage limit to include the value of your solar panels could increase your insurance payments by as little as $15 a month to upwards of a few hundred dollars.

-

Standalone solar panel insurance is useful for ground-mounted systems or solar carports, but generally isn’t needed for rooftop solar installations.

-

The warranties that come with your solar equipment and installation can provide coverage beyond homeowners insurance offers.

Does home insurance cover solar panels?

Yes, most homeowners insurance policies do cover solar panel systems. Since solar panels are considered a “permanent improvement” they are usually included under your dwelling coverage.

However, homeowners insurance isn’t all-inclusive. Some perils, like floods or earthquakes, are excluded from coverage unless you’ve purchased specific insurance coverage for those events. So, if your solar panels are damaged during an uncovered event, you’ll likely be the one paying for the repairs.

Make sure to read the fine print of your insurance coverage and speak with your insurance agency about what events are and are not covered when it comes to your solar panels.

Solar panels on your property but not on your roof may require additional coverage. If you install a ground-mounted solar system, a solar gazebo, or solar panels on another secondary structure, it won’t always qualify for dwelling coverage

Do solar panels increase home insurance costs?

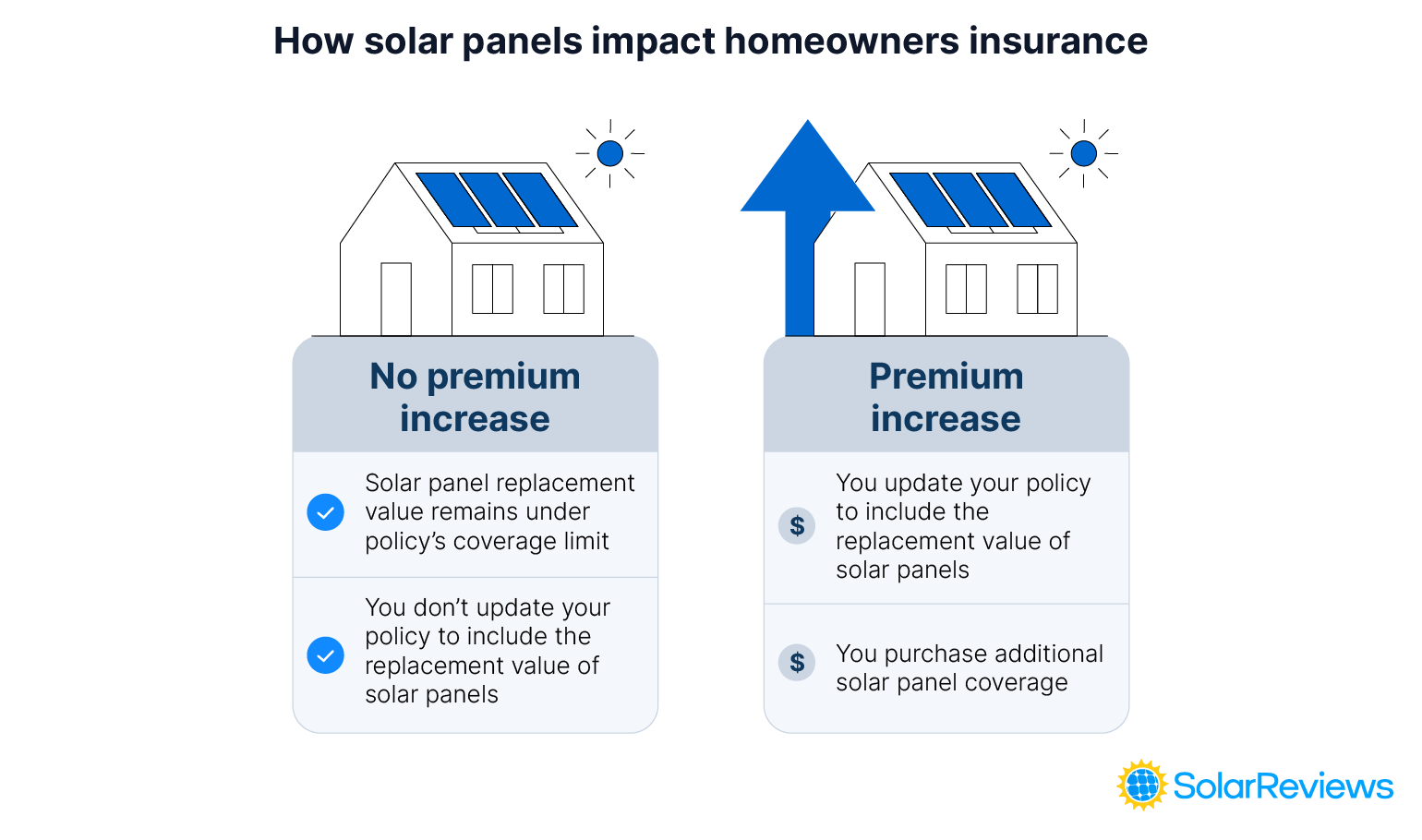

Solar panels may increase your homeowners insurance costs depending on your current policy’s coverage limit and if you choose to update it.

Your insurance premium will likely stay the same if the replacement value of your home with solar panels remains under your coverage limit.

Your insurance premium can increase if solar panels increase the replacement value of your home enough to exceed your coverage limit and you decide to adjust your coverage amount.

If you don’t adjust your coverage to cover the additional costs of solar, you likely won’t see an increased premium, but if something goes wrong, your insurance payout might not cover the full cost to replace the solar panels.

If you get a separate solar panel policy, you’ll likely have to pay more money because you’re adding an additional policy, which can be more expensive, but potentially more comprehensive.

For those who do see increased homeowners insurance costs after they go solar, payments can go up by as little as $15 a month, or closer to a thousand dollars if they choose to get a separate solar panel coverage policy.

How solar panels impact replacement value

Here’s how it works: when you take out a homeowners insurance policy, your insurer will include a specific amount of money they’ll cover in the event of a loss, usually related to the cost to rebuild your home.

When you make home improvement upgrades, like adding solar panels, your home’s replacement cost can increase. Sometimes, the increase will still fall below your coverage limit, so you don’t have anything to worry about.

This is where things can get tricky: sometimes, the new replacement value of your solar home will exceed the coverage amount listed in your existing homeowner's insurance policy. In this case, you could end up underinsured, meaning your insurance payout won’t be enough to rebuild your home and your solar panels.

To make sure everything is fully covered, you might have to adjust your policy with your insurance agent. Updating your coverage limit could increase how much you pay for homeowners insurance and impact your deductible, but you’ll know your investment is covered in the event of an emergency.

Solar leases and homeowners insurance. If you acquire solar panels through a power purchase agreement or solar lease, you don’t own the solar panels, so you don’t need to worry about coverage limits or exclusions in your own policy. Instead, the solar provider’s insurance company will cover the equipment, since they are the owners of the panels.

Do you need standalone solar panel insurance?

In most cases, you don’t need a separate policy to insure your solar panels, and you can just adjust your homeowners insurance policy to include the cost of the solar array. Adjusting your policy every few years is a good idea anyway, since some policies that don’t account for changes to property value over time may leave you with less coverage than you need, even without the addition of photovoltaic (PV) equipment.

You can obtain third-party solar coverage from companies like Solar Insure to add an extra level of proteciton to your solar investment. However, these coverages often act more like warranties than homeowners insurance, and they might even offer protections for you if your solar company goes out of business.

When you might need supplemental solar panel insurance

Most damages to your solar equipment should be covered either by your existing policy or by the solar warranties you get from your installer and equipment manufacturer. However, there are some cases where it might benefit you to take out a standalone solar panel insurance policy.

If your system is very expensive: The average cost of a solar panel system in the U.S. is $21,816, but your total could be significantly higher than this if you need an oversized array or want to include add-ons like solar batteries. If your homeowners insurance coverage doesn’t cover the cost of rebuilding your structure plus replacing your solar array, standalone coverage could be a more affordable option than increasing your homeowners insurance policy to make up the difference.

If you’re installing a ground-mount solar array: Ground-mount solar arrays are more often covered under auxiliary dwelling coverages, which are usually much lower than the coverage limits for your main structure. If you’re installing ground-mount panels or other structures like a solar carport, you’ll likely pay less for a standalone solar panel insurance policy than you would to increase your coverage limits with your existing homeowners insurance provider.

If your installer doesn’t offer solid warranty coverage: It’s a good idea to choose a solar installer that includes extensive coverage for your system, but if they don’t, a standalone policy could be beneficial. They typically cover more than homeowners insurance would and can include things like damage from poor workmanship and even losses if your system underperforms.

Understanding solar warranty coverage

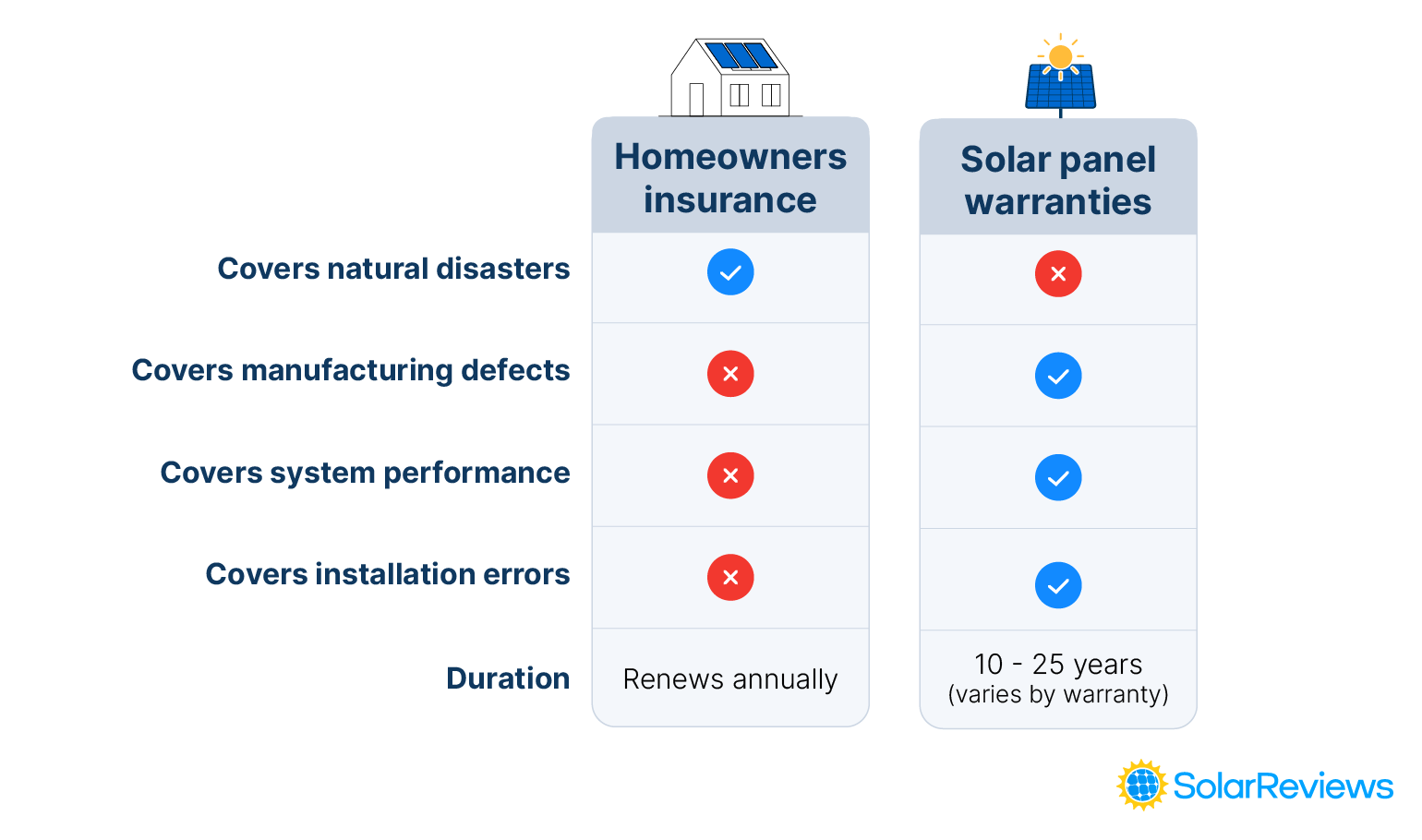

Aside from homeowners insurance, your solar equipment will be covered by warranties that protect you in case of equipment failures. Solar warranties generally protect your solar system from wear and tear, manufacturing defects, and installation errors, while homeowners insurance protects you from natural disasters.

There are usually three types of warranties that are associated with solar panels:

Equipment warranty: This warranty, provided by the manufacturer, covers manufacturer defects in the panels, inverters, batteries, and other equipment. Some equipment warranties can last for up to 40 years, but 25 to 30 years is the industry standard.

Production warranty: Most solar panel manufacturers guarantee that your panels will deliver a specific level of performance after installation. These policies usually guarantee that your panels will continue to operate at between 85% and 92% of their starting wattage by 25 years. Some manufacturers guarantee performance for 40 years.

Workmanship warranty: Workmanship or labor warranties are offered through the solar installer and guarantee that the installers responsible for installing your PV equipment won’t make mistakes that lead to premature failure. Labor warranties can last for anywhere between 5 and 40 years.

The solar warranties offered by manufacturers and installers can provide peace of mind that your solar array will function for decades to come, even if total replacement isn’t covered by your homeowners insurance provider.

Does homeowners insurance cover roof damage after solar panel installation?

Homeowners' insurance usually doesn’t cover poor workmanship, so if you experience a roof leak after your solar panel installation, chances are your existing homeowner's insurance policy won’t cover the damage.

However, those damages might be covered through your solar installer’s workmanship warranty. Review your solar warranty to see if there are any specific conditions around roof leaks, document the damage, and contact your installer.

This is one reason why it’s so important to choose a reputable solar installer and to look for one that offers a roof leak warranty. A reliable solar installer will not only offer coverage in case of these types of events, but their work will likely be high-quality, so you won’t have to worry about leaks or other damages from installation.

Dan has been a solar proponent for more than a decade now, and he has been researching and writing about solar and renewable energy for the past five years. He has first-hand experience with solar conversion, and he uses that and his research to help homeowners lower their electric bills and reduce their carbon footprint through solar education and adoption. He has written for major publications, including CNN, USA Today, and EcoWatch, and he has...

Learn more about Dan Simms