News

10 months ago

New tariffs from the Trump Administration could increase home solar fraud. We list 4 ways homeowners can stay protected.

Written by Catherine Lane

11 months ago

Recent Department of Energy layoffs and the creation of a new energy advisory board by the Trump Administration could increase American's energy bills.

Written by Catherine Lane

1 year ago

SEG Solar’s new manufacturing plant in Houston, Texas, will eventually be capable of producing 2 gigawatts of solar modules in a year.

Written by Ben Zientara

1 year ago

SunPower Corporation's bankruptcy rocked the home solar industry and sheds light on the future of solar financing.

Written by Ben Zientara

1 year ago

The closures of Titan Solar and major changes to Sunpower have the industry on edge — we think it's the beginning of a brighter future in home solar.

Written by Ben Zientara

1 year ago

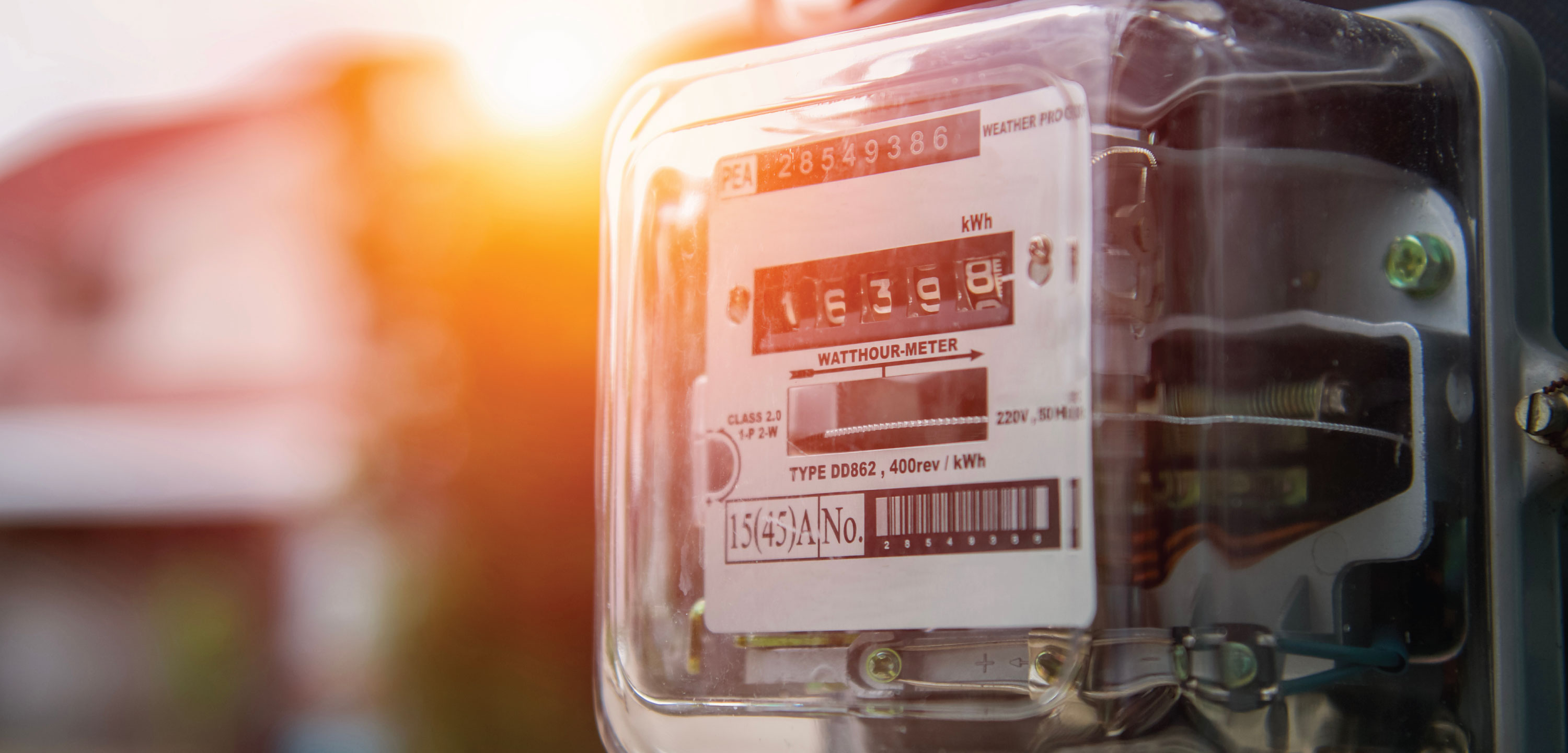

Rocky Mountain Power has filed to increase electric rates in Utah, which could be upwards of 20% based on filings the utility has made in other states.

Written by Catherine Lane

2 years ago

High electricity costs and smart appliances have made saving money and maximizing solar self-consumption easier than ever. Does net metering still matter?

Written by Ben Zientara

2 years ago

In this article, we discuss solar panel financing and whether solar leases and PPAs are making a comeback in 2023.

Written by Ben Zientara