Updated 1 year ago

SunPower will no longer manufacture solar panels - here's why

Written by

Catherine Lane

SunPower Corporation (SunPower) has announced its plan to split into two separate companies.

SunPower will continue to be a distributed generation energy services company while their new company, Maxeon Solar Technologies (Maxeon Solar), will focus on the manufacturing of solar panels.

Why the sudden split? How will it affect the solar market? Will it make an impact on the amount customers pay for solar panels? We answer these questions, and more.

SunPower Corporation's split from manufacturing

SunPower and Maxeon Solar are set to separate within the second quarter of 2020.

The split was made possible by a $298 million investment by Tianjin Zhonghuan Semiconductor Co. (TZS). TZS is a long-time partner of SunPower and one of the world’s leading suppliers of silicon wafers.

“This transaction will also simplify both organizational structures, lowering costs, while improving efficiency and creating more nimble companies,” said SunPower CEO Tom Werner during a November 11 2019 conference call.

By dividing into two separate companies, SunPower can focus on expanding the services it offers to consumers.

The new and improved SunPower

SunPower provides energy solutions to consumers by helping them design, implement, and monitor their solar projects. Once the companies divide, SunPower will no longer manufacture solar panels. However, it will still continue to supply the same solar services to customers.

Tom Werner will maintain his role as CEO at the company’s corporate headquarters in Silicon Valley.

SunPower Corporation has a network comprised of over 500 dealers that it works with. In order to be part of the network, solar installers must complete specialized training courses and meet various installation criteria.

The company then helps customers get in touch with these dealers in order to facilitate solar projects. SunPower also offers solar leases to assist customers with financing their solar systems.

The revamped SunPower is aiming to take its services a step further by expanding into the solar battery storage market. Projections indicate that battery storage is slated to become much more common in the coming years, giving SunPower potential to grow significantly in the energy storage sector.

The debut of Maxeon Solar

“Maxeon Solar is, at its core, a technology innovation company,” said Jeff Waters, future Maxeon Solar CEO. Waters is the current CEO for SunPower’s technologies business unit.

Maxeon Solar will be the company responsible for producing the high efficiency solar panels that SunPower is known for. It will be headquartered in Singapore, with factories in France, Malaysia, Mexico, and the Philippines.

The new locations will allow Maxeon Solar to take advantage of low-cost manufacturing processes throughout Asia. Plus, the partnership with TZS provides Maxeon Solar with access to TZS’s supply chain ties.

These factors will cause the cost of Maxeon solar panels to drop.

What’s on the agenda for Maxeon Solar?

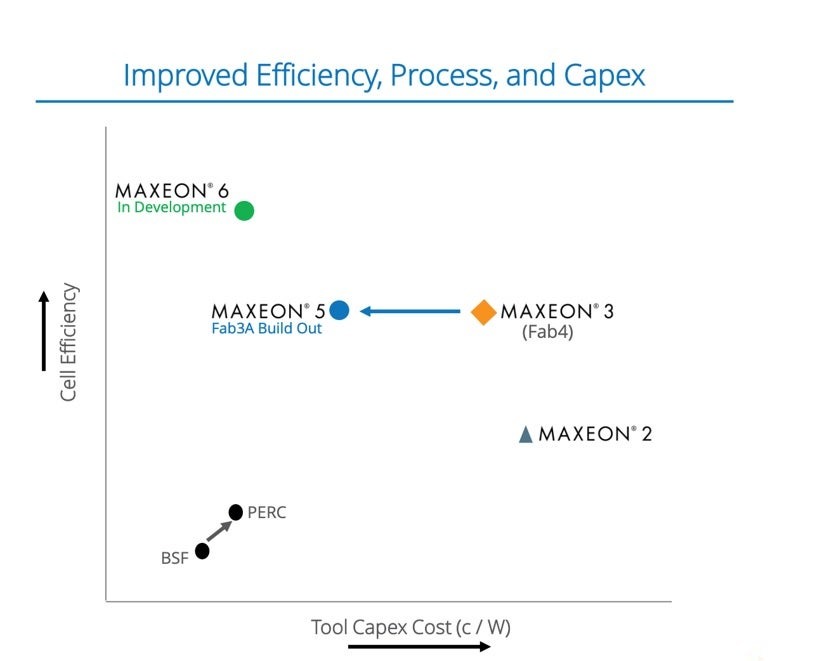

One of the manufacturer's first projects includes the development of the new Maxeon 6 solar panel. Early plans suggest that the model will be built through simple, low-cost manufacturing processes.

The processes would bring down the price of the panel while still maintaining a solar cell efficiency of 26%.

Image source: SunPower

SunPower and Maxeon are expected to enter into a multi-year exclusive supply agreement that will guarantee the deployment and distribution of Maxeon solar panels throughout the U.S.

However, Maxeon Solar is setting its sights beyond the U.S. and Canada, as it looks to enter the global market, as well. By taking advantage of cheap manufacturing, they can produce low-cost, high efficiency panels while becoming a global competitor.

SunPower likely didn't take advantage of cheap overseas manufacturing due to the tariffs imposed on imported solar modules by the Trump administration. Maxeon Solar realized that in order to be successful outside of the U.S., they must manufacture cheap solar panels, which is much more feasible when done internationally.

How does the Sunpower split impact investors?

SunPower Corporation is a publicly traded company, meaning that its ownership is organized by stocks, which are owned by investors. Current shareholders will receive a 71% stake in Maxeon Solar when the company becomes public.

SunPower’s stocks have fluctuated quite a bit in the past. After the announcement of Maxeon Solar, SunPower’s stock value increased by about 15%. They eventually fell back down to just about 1% higher than the previous value.

As of November 20, 2019, its stock is valued around $8.53.

Image source: Yahoo Finance

By splitting in two, each individual company will be able to streamline operations and lower their costs. Lower costs should lead to SunPower seeing higher profits.

After seeing profits increase in the third quarter of 2019, SunPower’s stocks also increased, which suggests that if the newly structured SunPower has higher profits, it could increase the value of their stocks, as well.

What does this mean for the solar industry?

If Maxeon Solar is successful in expanding into the global market, they could seriously shake up the solar industry. The Maxeon 5 panels that are currently available are some of the most efficient solar panels on the market.

Maxeon Solar could produce high-efficiency panels that sell for a competitive price by:

Increasing the scale of production;

Decreasing the cost of manufacturing; and

Deploying solar in international markets.

This would put pressure on other solar panel manufacturers to bring down their prices and crank up their efficiency.

If more manufacturers were creating high efficiency panels at low prices, solar could become much more affordable. This could be the type of change the industry needs, especially with incentives like the federal tax credit expiring in the near future.

Catherine is a solar industry analyst and content manager with five years of experience researching and reporting on residential solar. As the former Written Content Manager at SolarReviews, she led a team producing informative content to help homeowners make informed decisions about solar investments. Her expertise has been featured in Solar Today Magazine and Solar Industry Magazine, with insights cited by major outlets including Forbes and Bl...

Learn more about Catherine Lane